Paying your Europe VAT

This post assumes you’ve already registered for your ROS account so you can pay your taxes. If you haven’t, head over to the Europe VAT OSS Registration post for a walk through on how to do that.

To pay your taxes, head over to https://ros.ie/ and sign in using the certificate you generated in the registration process. Your password will be the same one you used when generating the certificate.

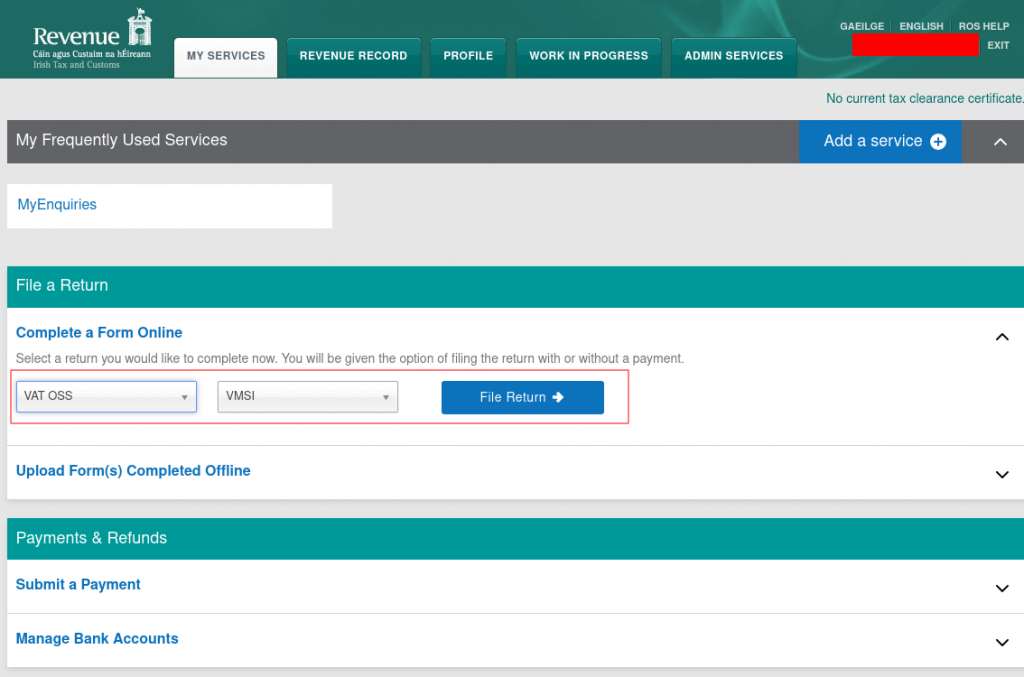

After you’re logged in, you should see a page like this. Click Complete a Form Online, select VAT OSS, VMSI, and File Return

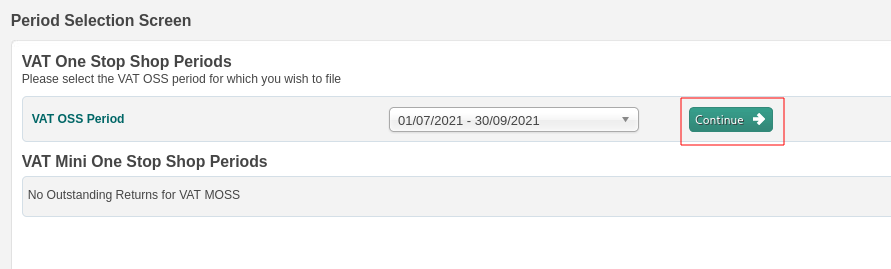

Select the payment period, which should default to the last one, likely the one you need to pay. Click Continue

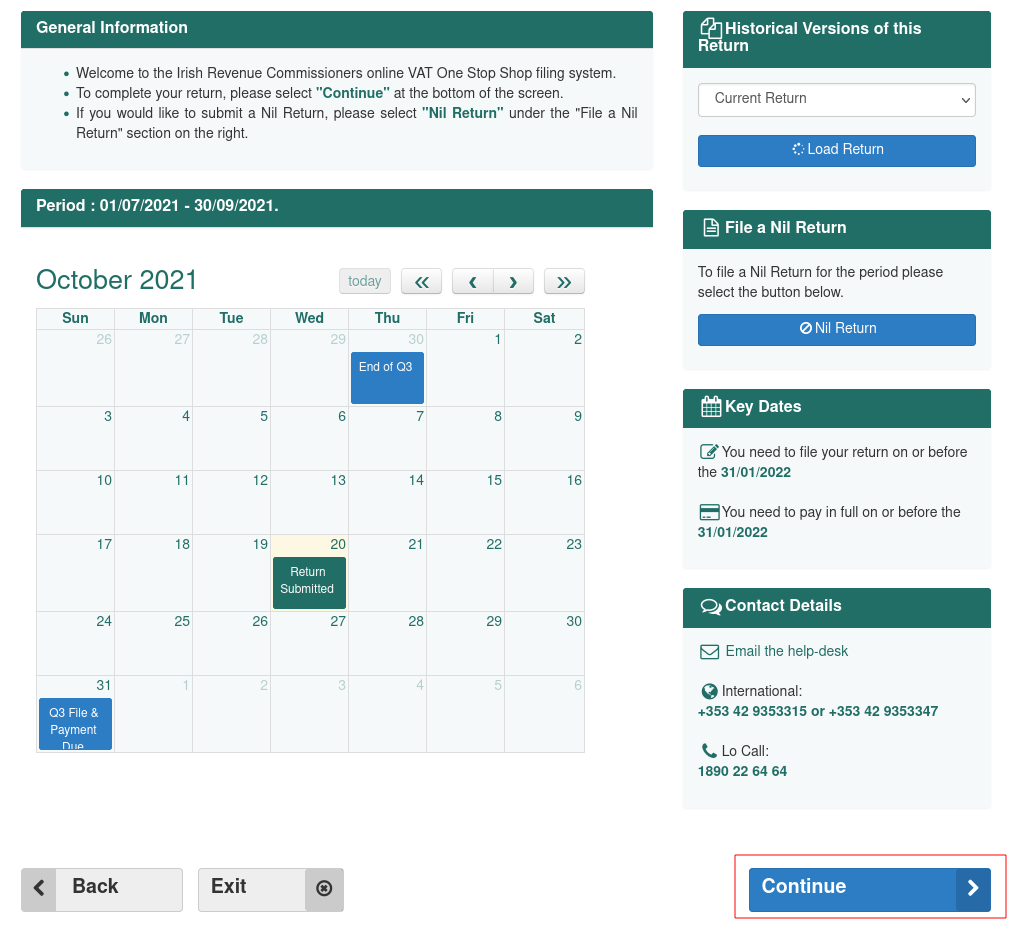

Next page, click continue

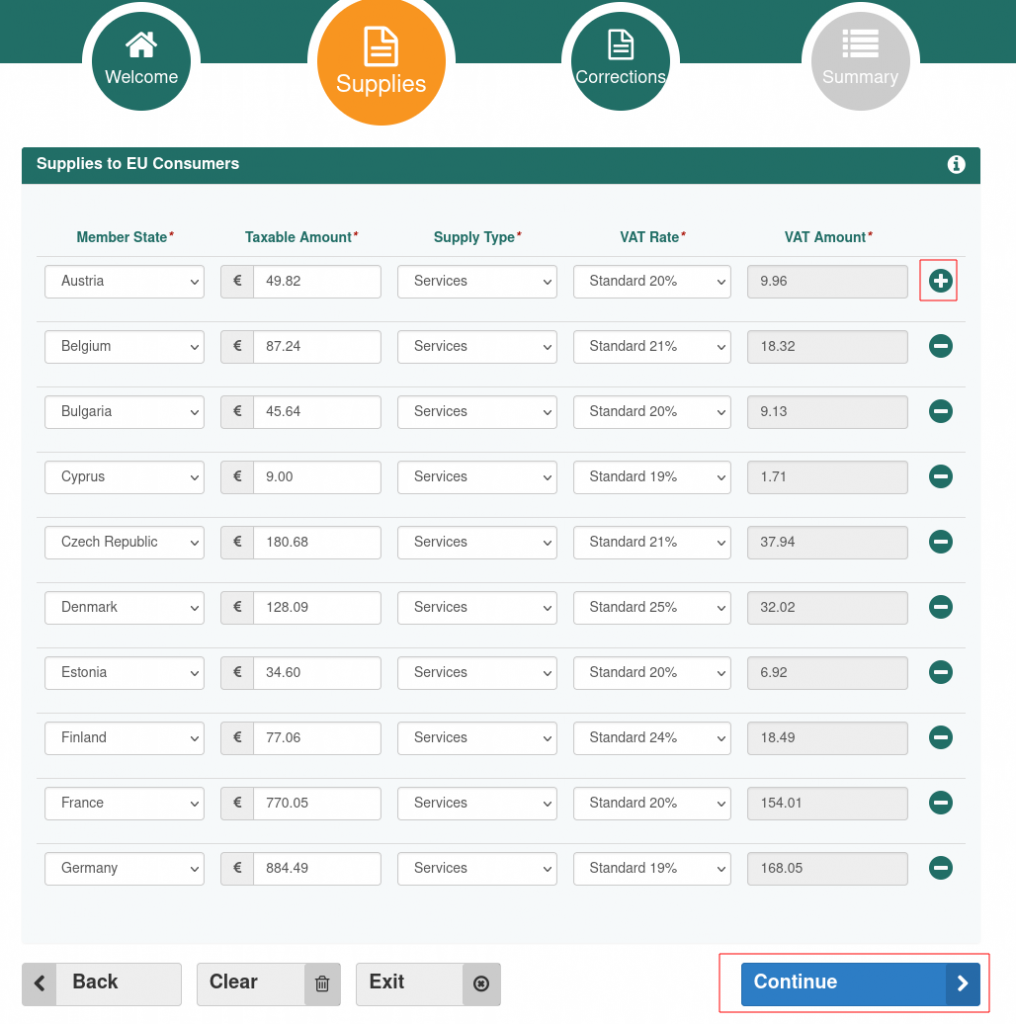

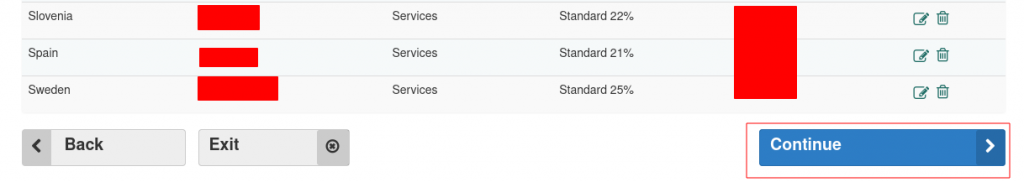

Next page you fill in the revenue for all the countries you received payments from. Keep clicking the “+” button until you have enough lines for each country.

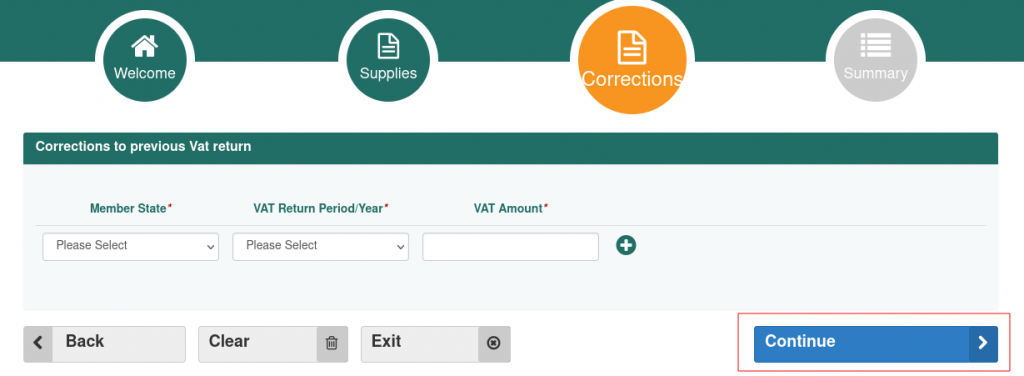

After you’ve filled out all of your revenue details, click Continue. The next screen is for corrections, if you don’t have any, click continue.

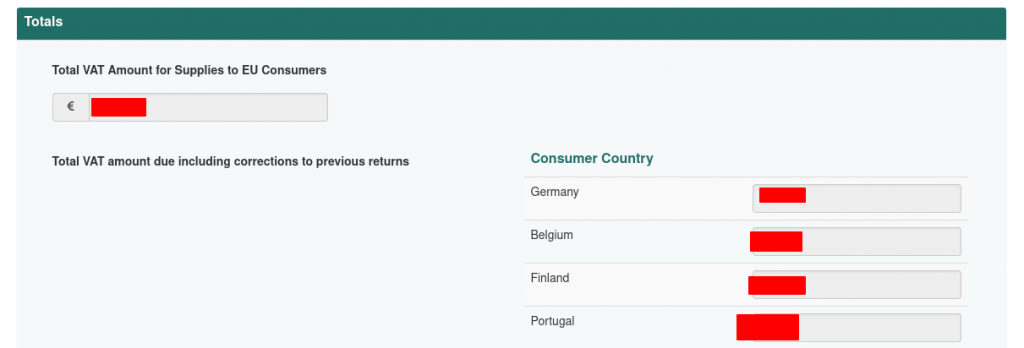

Next page, confirm your amounts. WRITE DOWN HOW MUCH YOU OWE and click Continue. at the time of writing, there’s no easy way to view this screen again once it’s submitted, so you need to write down how much you owe so you can pay it in the next phase.

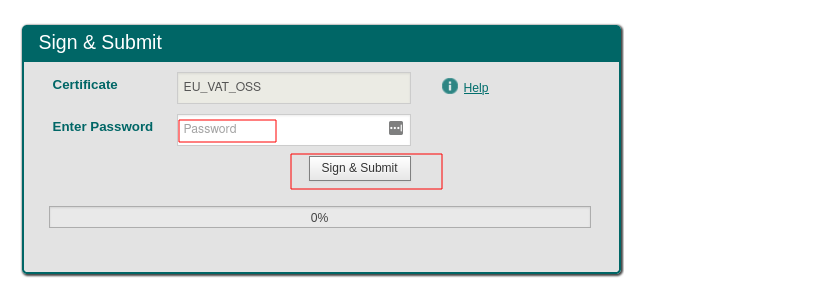

Next page, enter your certificate password

Now that you’ve created your return, it’s time to pay it (technically you might have some time to pay it depending on when you file, but lets take care of it now.)

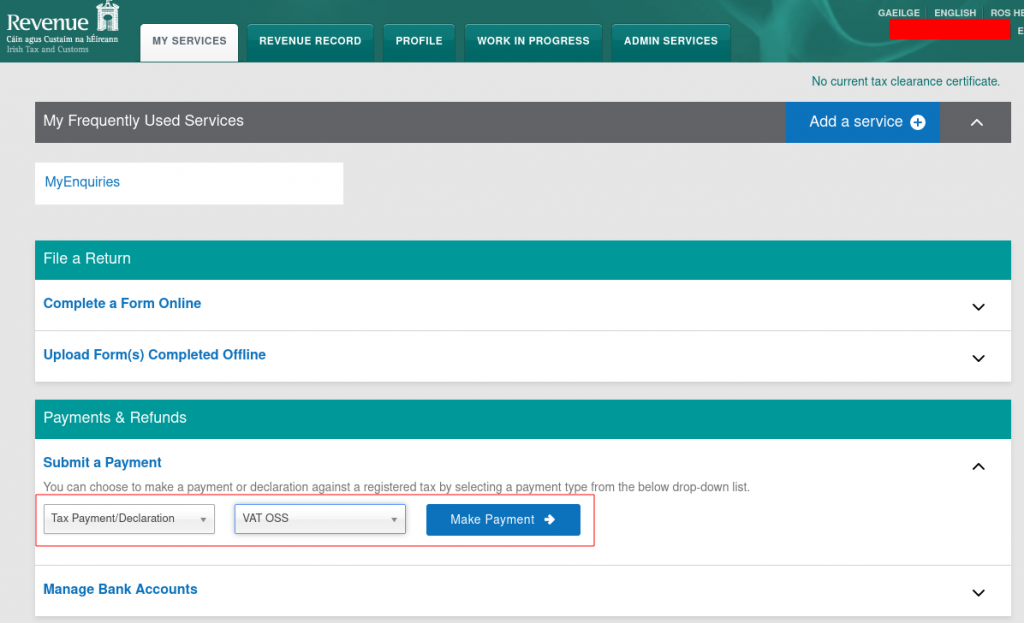

Head back to the main ROS screen, click Payments & Refunds, Tax Payment, VAT OSS, and Make Payment

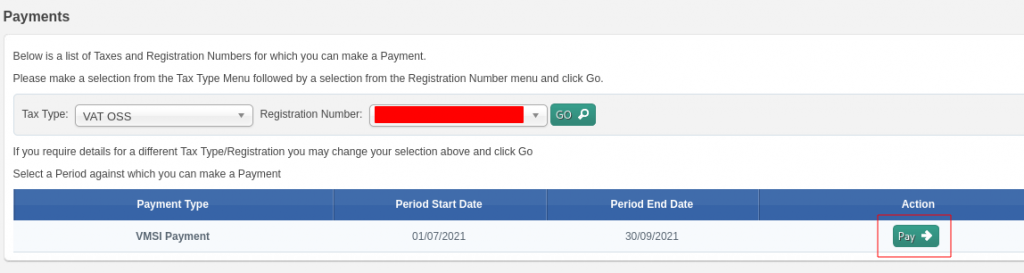

Next, click the VMSI payment associated with the period date you just filed for

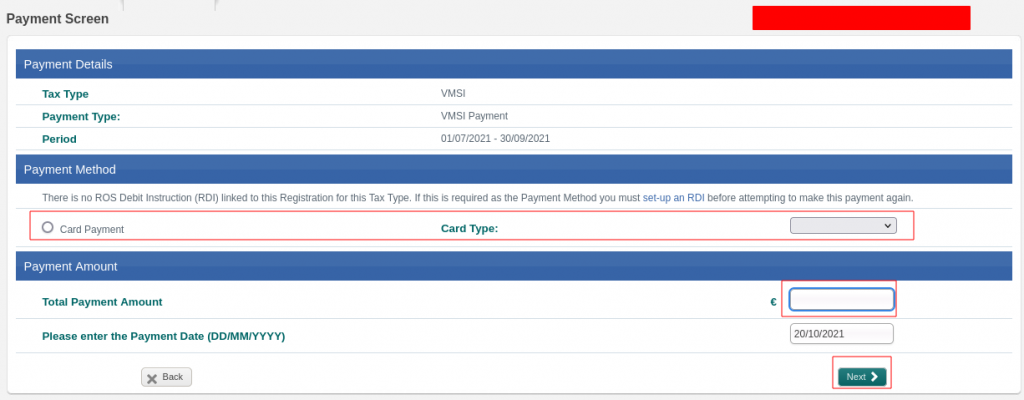

Provide your payment details and click Next

Confirm your details and click Proceed with Payment

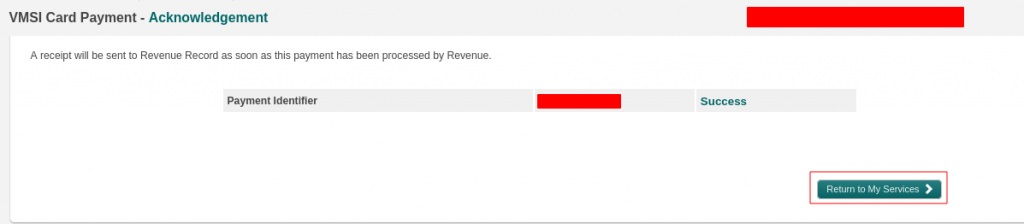

Proceed with entering your card information, or however you are choosing to pay for things. When the payment is complete you’re presented with a screen something like this:

That’s it, you just paid EU VAT taxes!