Europe VAT OSS Registration

If you’re selling digital services to customers in the EU, their “One Stop Shop” (OSS)* is what you want to deal with. I say this like there’s only one. No, instead of having just one, each country has their own One Stop Shop that you can use to pay taxes for all countries in the EU. If you live in the EU**, use your countries’. Otherwise, if you’re an English speaking non EU entity like myself, use Ireland like the rest of the world. (As a non EU registrant you can pick any country to setup shop in, but unless you speak another language better, Ireland is probably our best bet since English is their official language.)

P.S. If you’re selling physical goods, I think you need the IOSS (Import One Stop Shop), but I don’t do that so you’re on your own for navigating that, hopefully the process is not too dissimilar though.

* The “One Stop Shop” used to be called the “Mini One Stop Shop”, so sometimes you’ll see MOSS thrown around. That is just an old name for the OSS, or they merged, or something. But when you see MOSS, know that it’s our OSS.

** If you live in the EU, or you have offices or any actual presence in the EU, your rules are different and what you do are different, don’t follow this guide.

Links:

https://europa.eu/ is the official European Union website. Information on here should be the most up to date, and can be considered trustworthy. However, this is not where you’ll deal with registering and paying VAT.

https://revenue.ie/ is the official Irish tax and customs website. As an English speaker, this is the site you’ll want to use to get the process started, although soon you’ll be redirected to a https://ros.ie/ site for doing the actual registration and paying.

https://www.ros.ie/ is the official Irish “Revenue Online Services” site – this is where the actual registration and interaction happens.

Registering

Official instructions for what we’re doing are here:

Head to

https://www.ros.ie/vatoss-web/vatoss.html

and click register

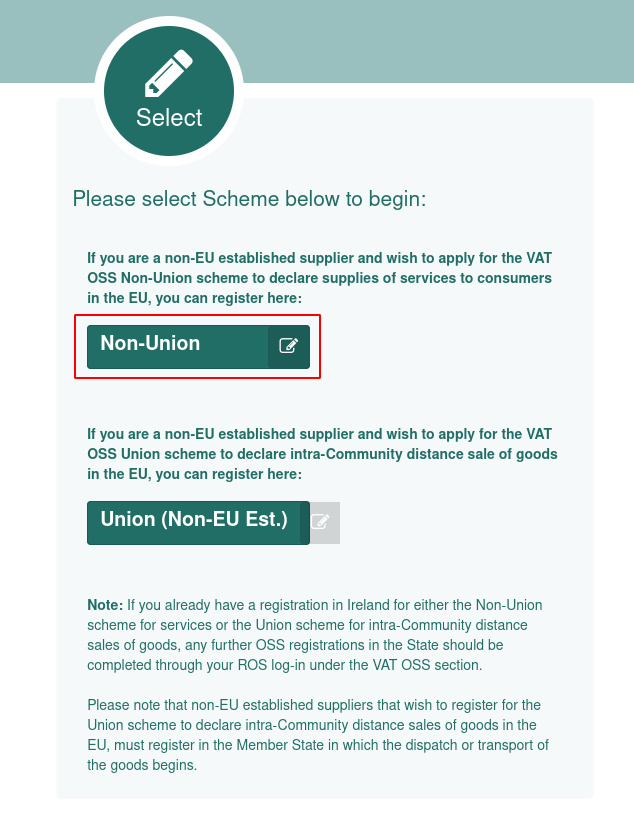

Then, if you’re like me selling a digital service, click ‘Non-Union’ scheme

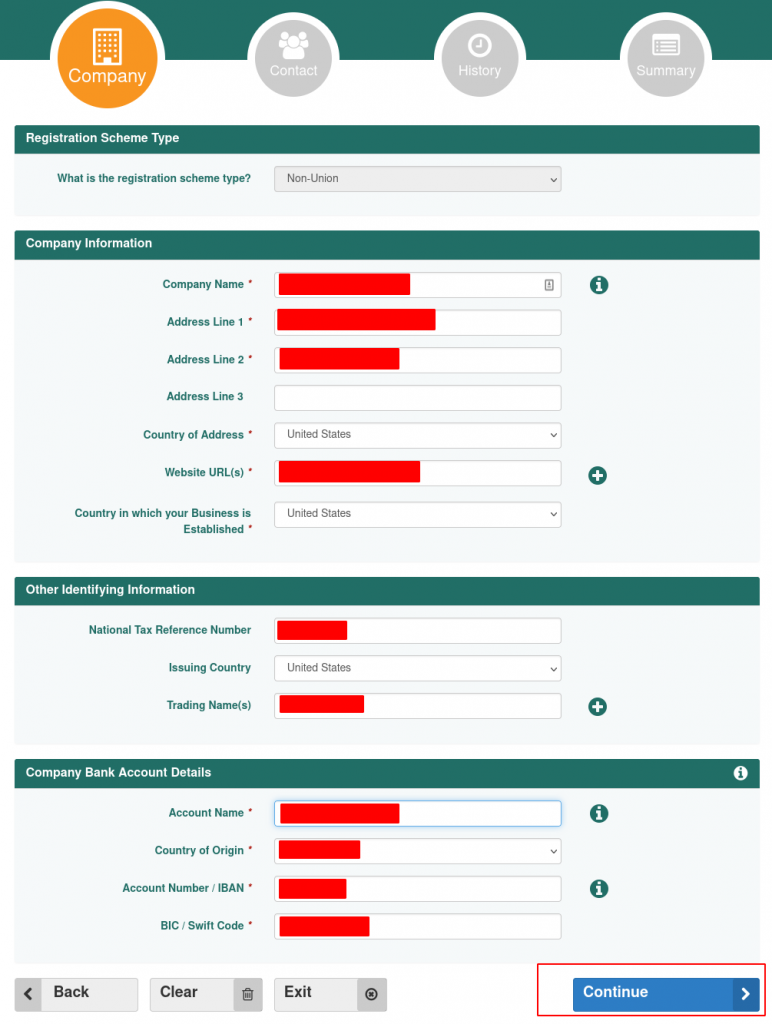

Fill out your details. Note your account number / iban and bic / swift code are not going to be a US bank routing / account number, look for those numbers in your banks international wire details.

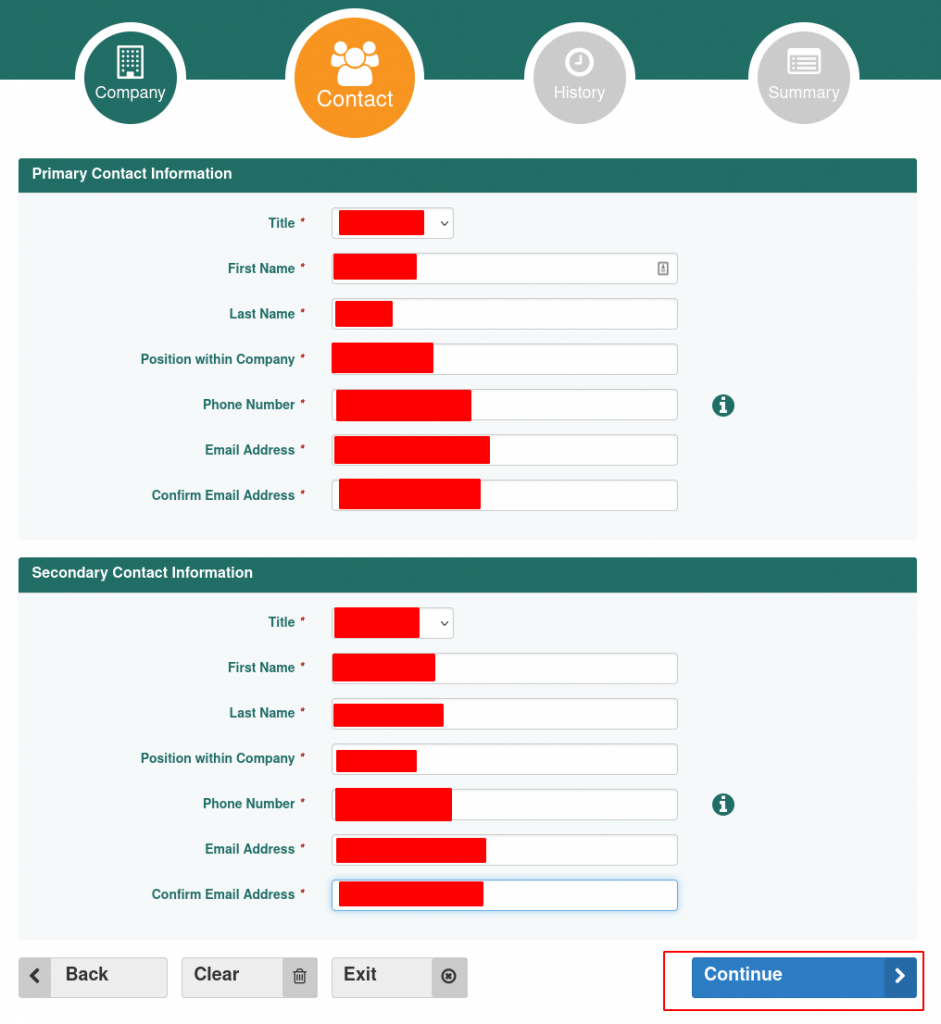

Fill in your contact information. My company only has one employee, me, unfortunately you can’t fill out the same contact information for both. I provided a second email and phone number for myself, and used “President” for the first position and “CEO” for the second, that seemed to let me through.

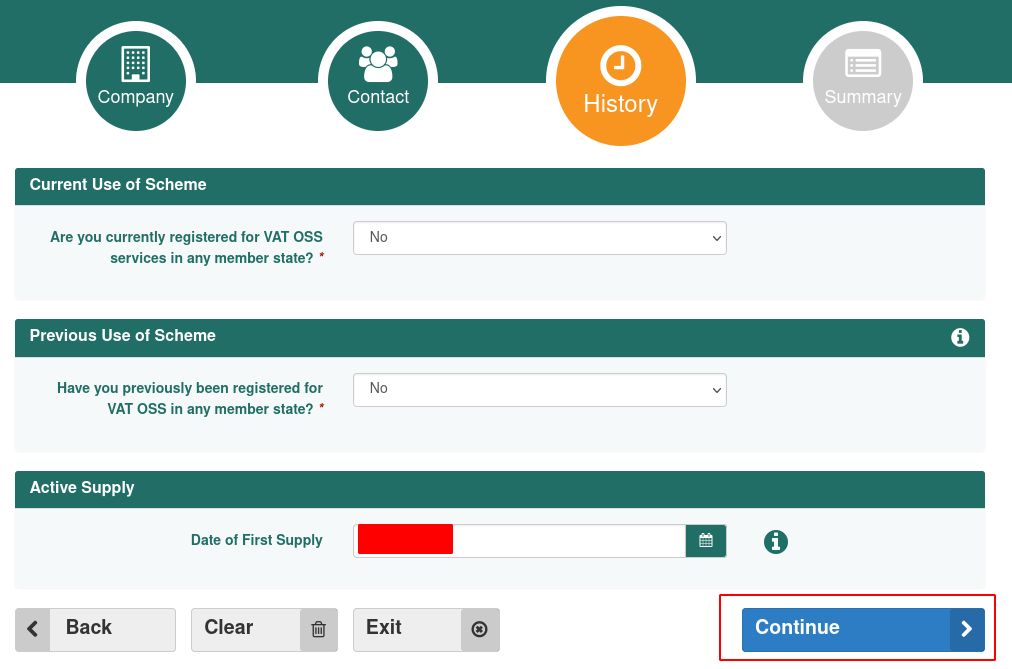

Fill in when you started selling stuff

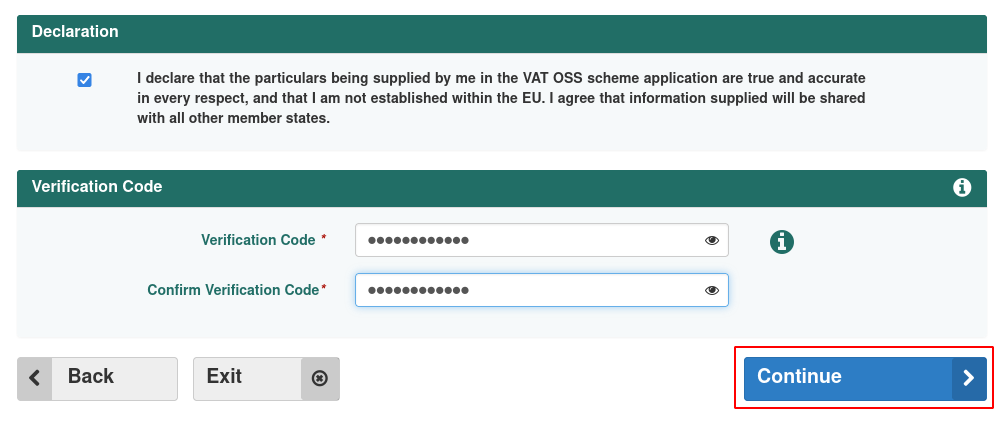

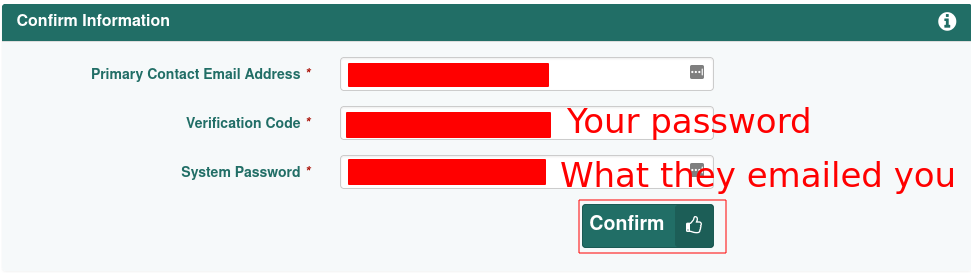

Verify all of your information and pick a password, aka “Verification Code”

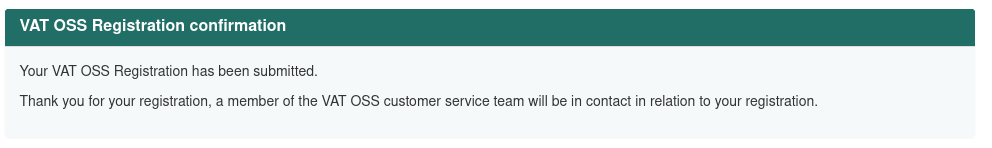

and that’s it! You should see a screen that looks something like

Confirming

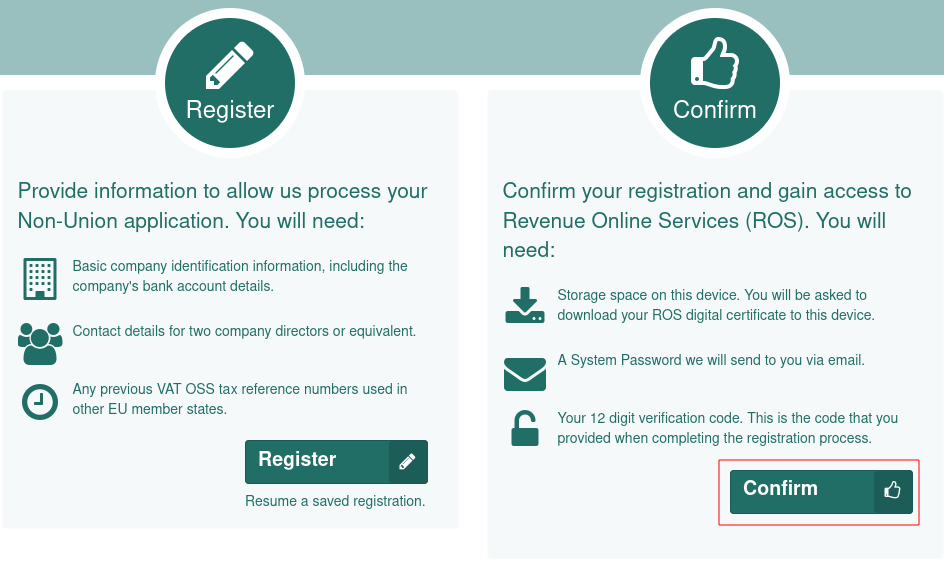

After a little bit they’ll email you a confirmation email along with a system password. They’ll also note to please allow some additional time (in my case 2 days) for my digital certificate to become available. After waiting a bit, continue on with the confirmation process by heading back to https://www.ros.ie/vatoss-web/vatoss.html and clicking Confirm this time

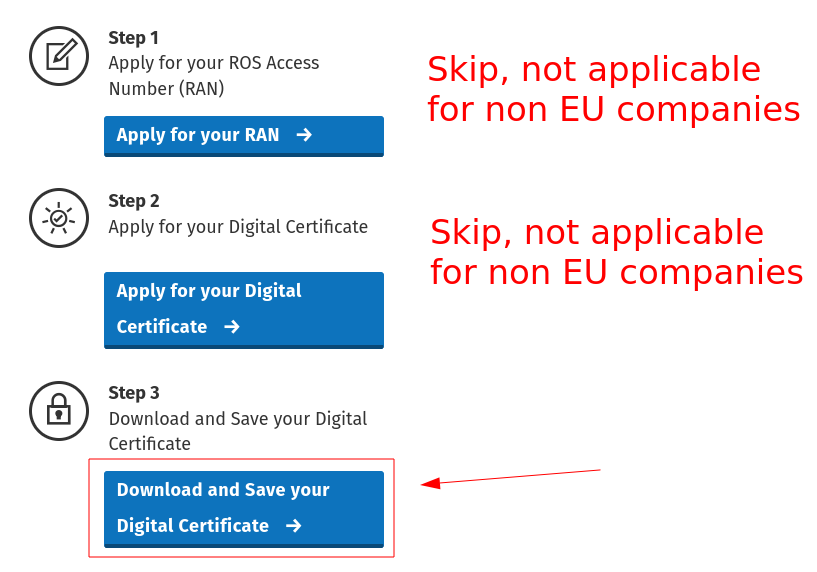

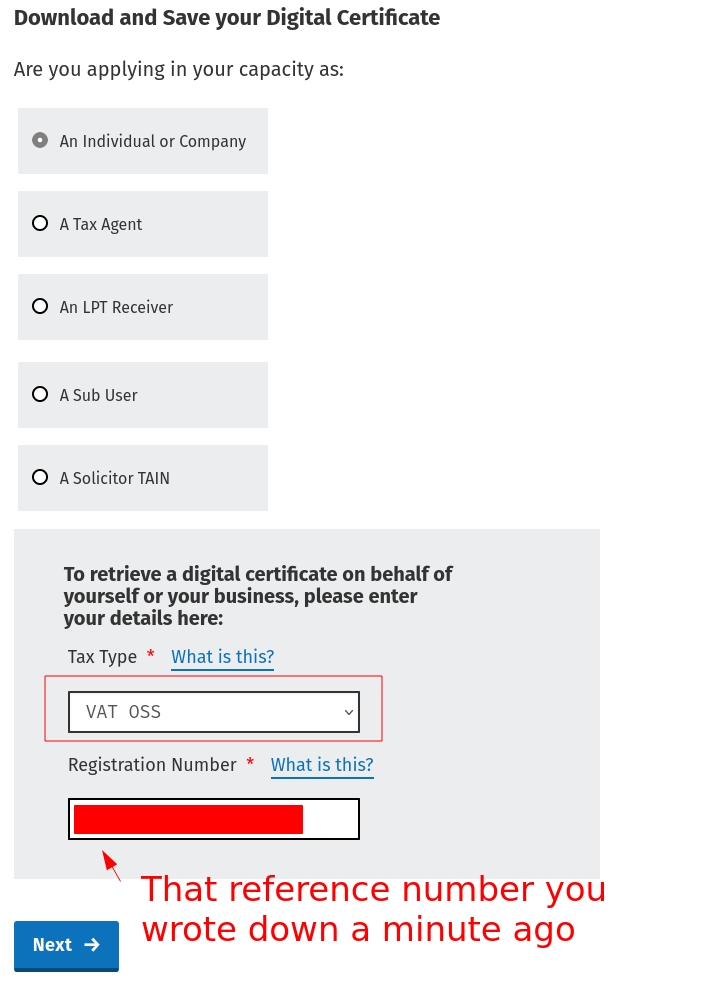

After clicking Confirm, you should see your tax reference number pop up (write this down), and then click “Download Digital Certificate”

For the next step, because we are not an EU entity but rather did this external registration process, we don’t need to do steps 1 and steps 2, we just skip to step 3, downloading our certificate.

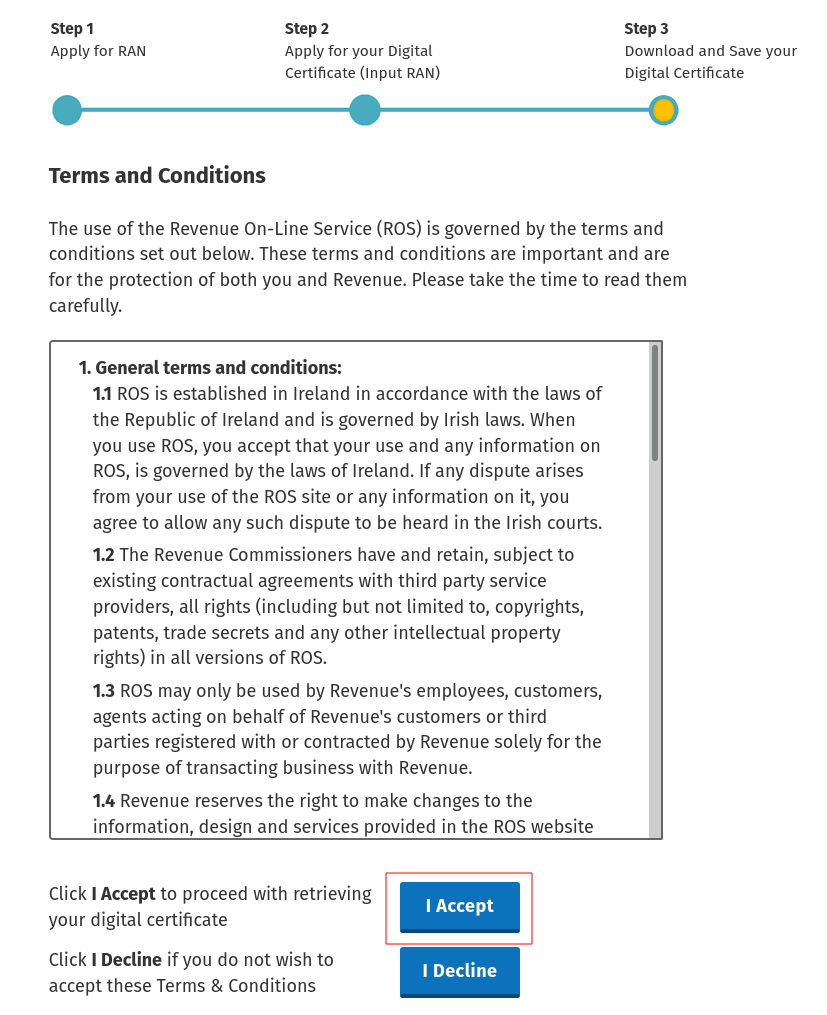

Then we’ll be presented with another screen to accept some ToS, read and accept if you accept

And another screen,

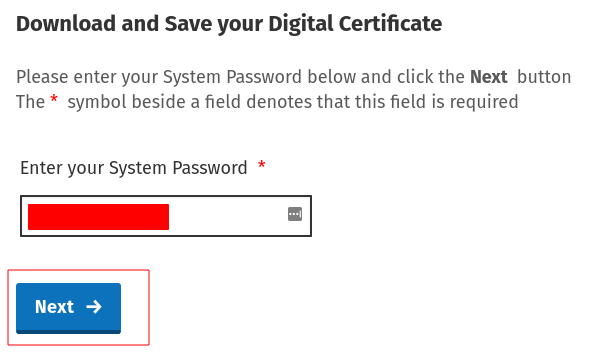

After this you’ll see another screen asking for your system password again (that’s the one that came in your email)

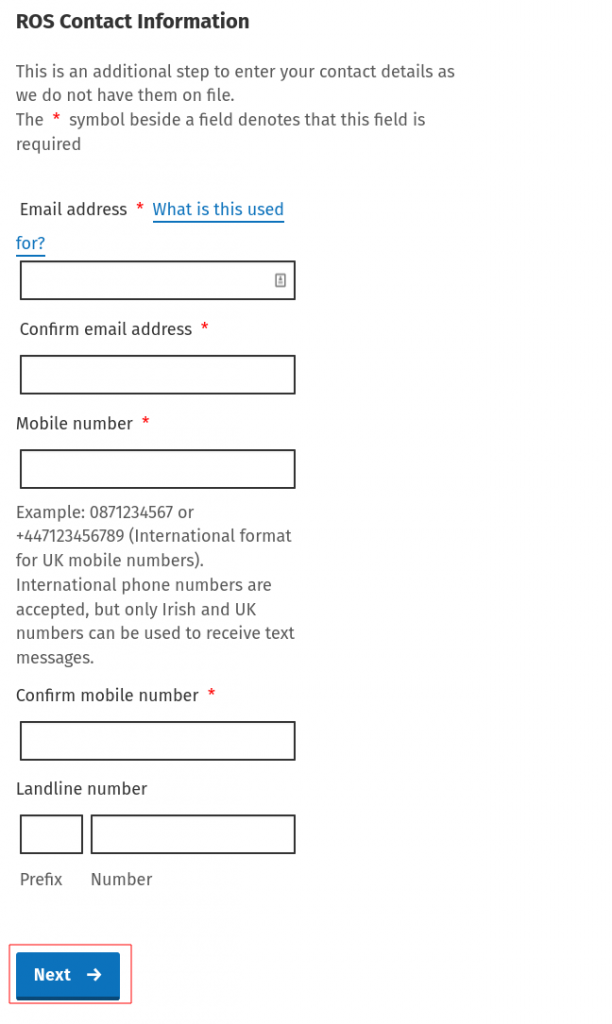

Fill out more information

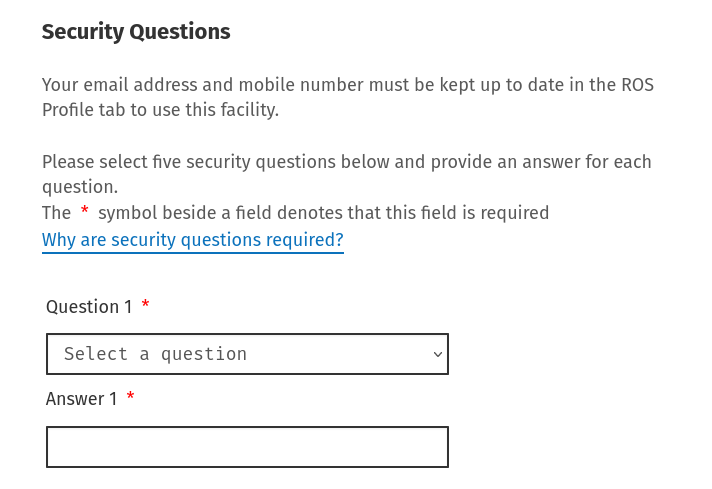

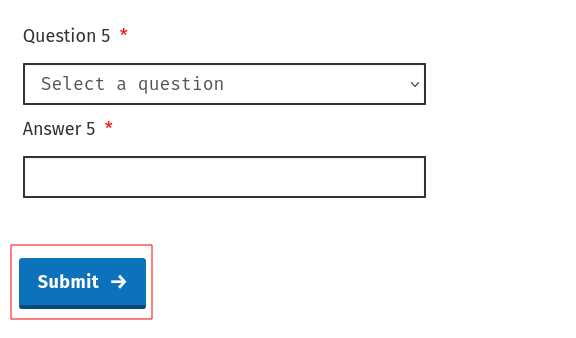

You’ll then be presented with a screen to enter security questions

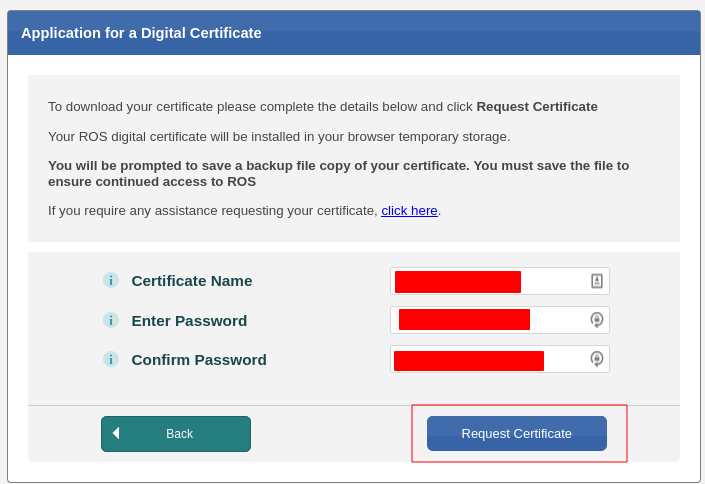

Finally, we get to the screen where we can actually download our certificate. You can provide anything for your certificate name, probably something like “EU_VAT_OSS” or something memorable. It can only have up to 20 characters long, and no spaces, dashes, or periods. For your password, this is a new password for your certificate so set it to something you can remember or can lookup.

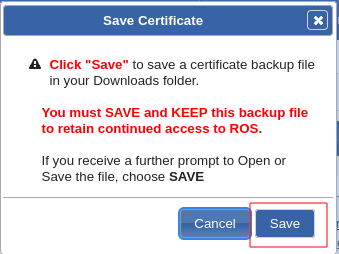

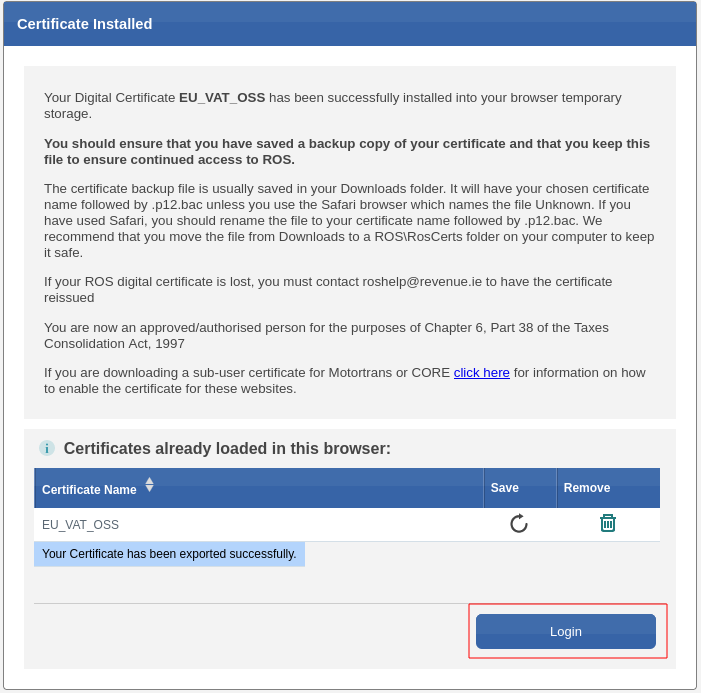

After a minute or so of the system generating your certificate, you’ll move to the next screen which has a popup to save your certificate. Save it somewhere safe, preferably with a backup or three.

After saving that file, you can progress to logging in with the certificate.

Logging in

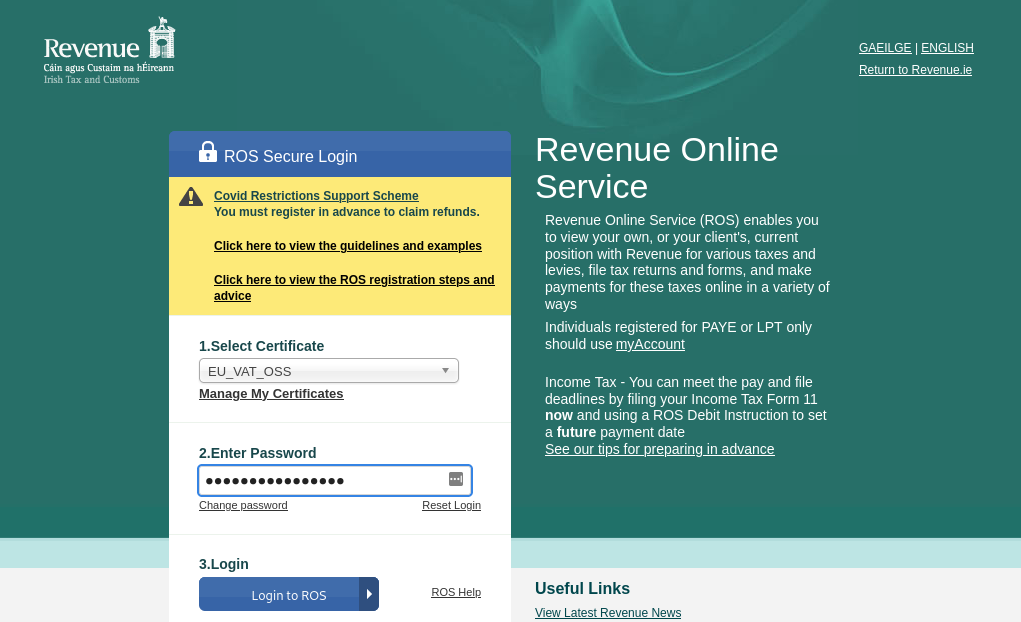

To login, head to https://ros.ie/ and you should be presented with a screen that allows you to log in with your new certificate. For your password, use the password you entered when generating your certificate.

As for what to do next, I’ll walk through my process in my next post, when I need to actually pay my first quarter of taxes.